Successful companies are struggling with steady growth, especially with long lead times due to manual processes and distributed data. These are available from various systems with different formats, but the merging is time-consuming and cost-intensive for the department. This affects the performance of the finance department and the fast provision of up-to-date data for further activities. By using a software solution independent of the ERP system, maximum flexibility in processing complex numerical material is guaranteed, and existing data can be reliably supplemented in the leading system.

Bank statements (Swift MT 940 / CAMT.053) provided by banks can be read directly into the Litreca system. For this purpose, master and transaction data are also transferred from the ERP system and reconciled with the bank transactions.

In order to achieve a high hit rate, the hit logic is specially adapted to the customer’s needs. Own criteria for frequently encountered business transactions are fully or partially automated with so-called booking templates and complement the process by looking at the history.

The counting resulting from the processing is fed back into the leading ERP system and booked there via the existing routines. The ERP-independent software is completely modular and adapts to the needs of the company thanks to its extensive scalability. In this way, companies achieve a very high automatic counting rate, which has a more than positive effect on the time relief of all employees in the finance department. Frequently recurring business transactions can also be automated in the system with the help of accounting rules and guarantee decreasing post-processing in the future.

Existing notices can be processed in various forms, regardless of whether they are available in paper or electronic form. Comprehensive reporting is available to companies to provide a better overview of ongoing processes and further optimization. Under various aspects, the hit rates are shown in an overview, differentiated according to subdivisions and time periods, as well as on the basis of turnover or opinion positions or resulting stockings.

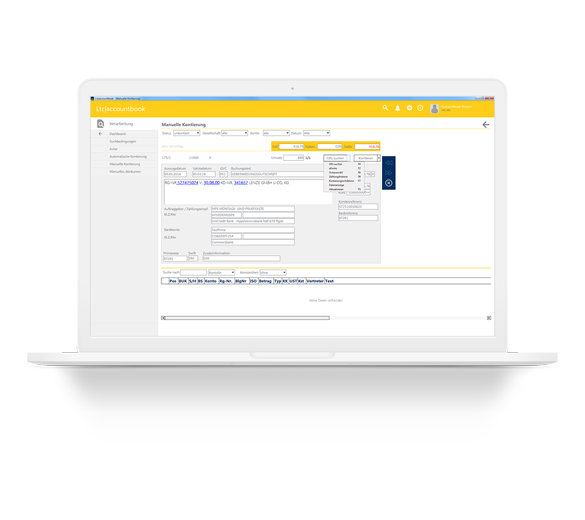

A modern dashboard shows information about the current status of the account statement processing, while the individual widgets are also provided with the possibility to jump into the sub-areas.

Ltc|accountbook is used across industries and is also available in English.

- Clear open items of all types of accounts

- Processing of account payments, Distribution of booking etc.

- Dialogue-based post-processing

- Export Interfaces

- Comprehensive reporting on request

- Processing of payment advice notes

- Accounting protocols

- Improvement of DSO (Days Sales Outstanding)

- Creation of payment files on request

This is only a small excerpt of the functions included in Ltc|accountbook. For the full function overview, please feel free to contact us.

Then arrange a non-binding online presentation now, where you can take part from the comfort of your desk. Your personal contact person will present the system to you and competently answer your questions.

How long does it take to implement Ltc|accountbook?

The time required to switch from manual to automatic Processing of bank statements depends on the company’s own Specifics; in the ideal case and when illustrating common themes, an imlementation within 2 weeks to 3 months is possible, depending on complexity.

Can payment advice be processed?

Yes, electronic payment advice can be processed. Depending on the industry, there is great potential to fully automate the manual processing of these advice notes. What has been common in the industry for some time now is a focus on smart automation, especially for retail companies

Can users create rules independently?

Yes, the user has this option, taking into account his rights. Employees in the finance department decide independently what exactly these rules should look like – the aim is to further consolidate the know-how in the specialist department and to relieve the burden on in-house IT support, for example.

We will be happy to answer your further questions about Ltc|accountbook personally.