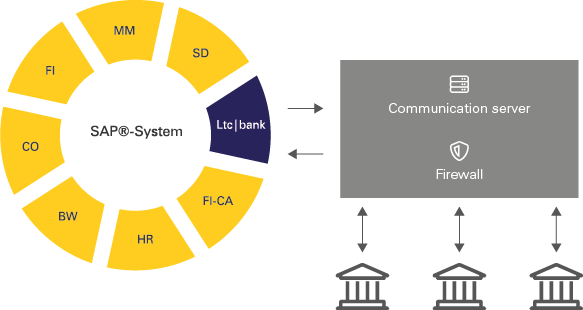

Efficient payment management is essential for medium-sized and large companies. Existing landscapes and industry-specific functions have to be taken into account. Security and reliability, especially in the sensitive area of payment transactions, should be a special focus. Full integration into SAP plays a leading role for everyone, in which data security and seamless processing must be guaranteed.

The software integrated in the SAP system is subject to the existing authorization concept. The authorization objects themselves are created in Litreca AG’s own authorization class. A completely sealed-off environment ensures that no unauthorized access takes place. All data leaves the SAP system environment only during the transfer to the house bank – no payment file is stored on a drive.

All house banks created in SAP are automatically suggested for configuration in the mapping. The company only assigns to the banks the users with their respective rights and obligations. Release strategies are implemented via workflow and employees are informed by e-mail that files to be released are available, including representation rules. Signatures of employees who are temporarily on the road can be made via secure web application. Another option is the “Corporate Seal” agreement with the house banks, which gives the department even more freedom.

Thanks to EBICS, companies can exchange data quickly and securely – in the SEPA region and worldwide. Benefits include the transfer of large amounts of data, fast and securely using modern encryption and the ability to provide shared electronic signatures; Several people must sign for an order to be processed (e.g. four-eye principle).

Communication with the house banks takes place directly from Ltc|bank in SAP®. Document management is used to generate correspondence with the banks, such as registrations, de-registrations, signature sheets, etc. All documents are also stored in the document archive and can be retrieved at any time. Ltc|bank in SAP® monitors the proper dispatch of files to the house banks at any time, which can be done automatically and optionally according to time clocks or event-driven. Status information on the files sent to the bank can be called up by the clicking on the mouse.

- User-controlled Monitoring of pending tasks

- Manual ad hoc payments

- Simple cash pooling

- Status call of workflows and data transfer

- Corporate Seal

- Representation arrangements for defined work packages

- Twist Fee Monitor

- Multi-mandate data and multi-bank capability

- Browser-based release

- In-memory database SAP HANA capable

This is only a small excerpt of the functions included in Ltc|bank in SAP. For the complete function overview, please feel free to contact us.

Then arrange a non-binding online presentation now, where you can take part from the comfort of your desk. Your personal contact person will present the system to you and competently answer your questions.

How long does it take to implement Ltc|bank in SAP?

What is the big advantage over my current banking software?

On the one hand, Ltc|bank in SAP takes over the functions you know from your banking software. In addition, however, we focus on security. Fully integrated into your SAP system landscape, the individually configurable release processes in combination with other test routines ensure a very high level of prevention of attacks and manipulation.

Can manual payments also be generated?

Yes, a clear user interface with template management is available for this purpose. This provides the internal flexibility that such a tool brings with it.

We will be happy to answer your further questions about Ltc|bank in SAP® personally.