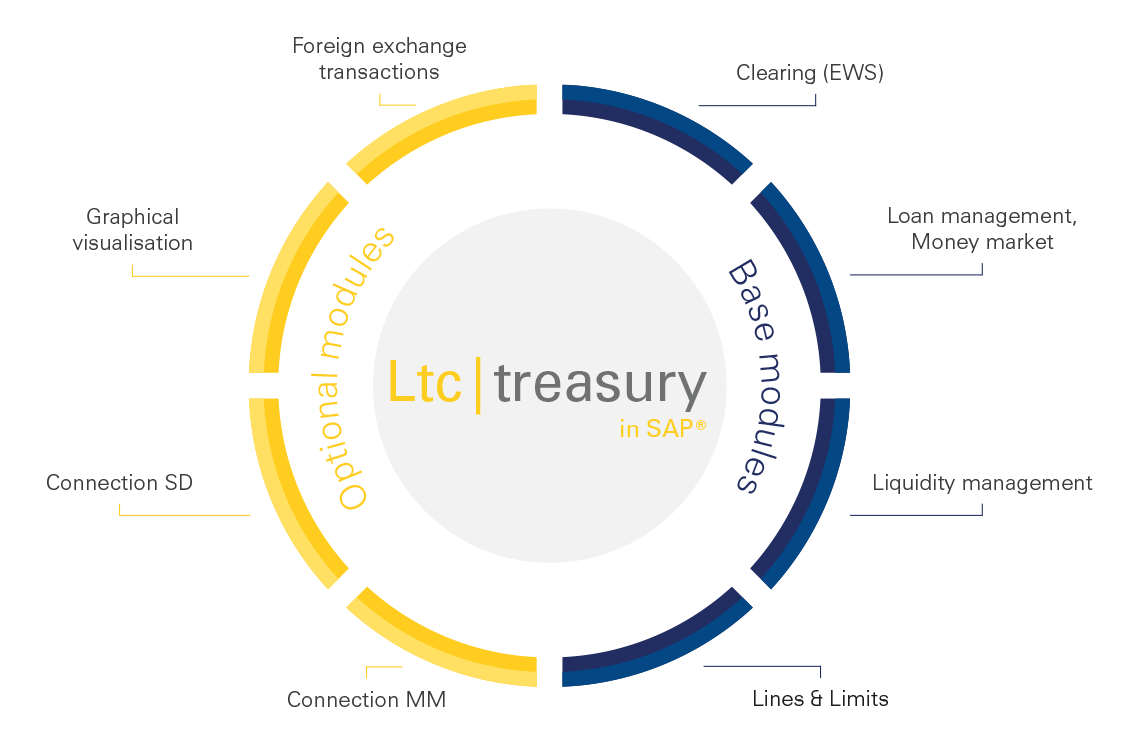

Ltc|treasury in SAP® offers a customized, flexible solution for cash and treasury management. Modular Components offer treasurers everything they need to build a flexible treasury system within SAP. Financial managers receive a central database and comprehensive functions to be able to meet the challenges of modern treasury management systemically.

Ltc|treasury in SAP® provides a complete and consistent picture of the company’s financial and liquidity situation and future development. There is no need to leave the SAP system landscape. In addition, no special IT resources are required, as the Treasury department can take over configurations and system maintenance itself if required. The release and access permissions are of course separate and can be configured outside Ltc|treasury in SAP® by your IT department.

Centralized planning allows the mapping of all company-specific functions, for which only the previous structure of liquidity planning is required. This structure is adopted in SAP and the corresponding sources from SAP systems are assigned to the liquidity positions. Where unavoidable, data can also be uploaded from Excel. The individual files are consolidated in a central database.

In this way, all cash flow-relevant processes are automatically integrated into the liquidity planning.

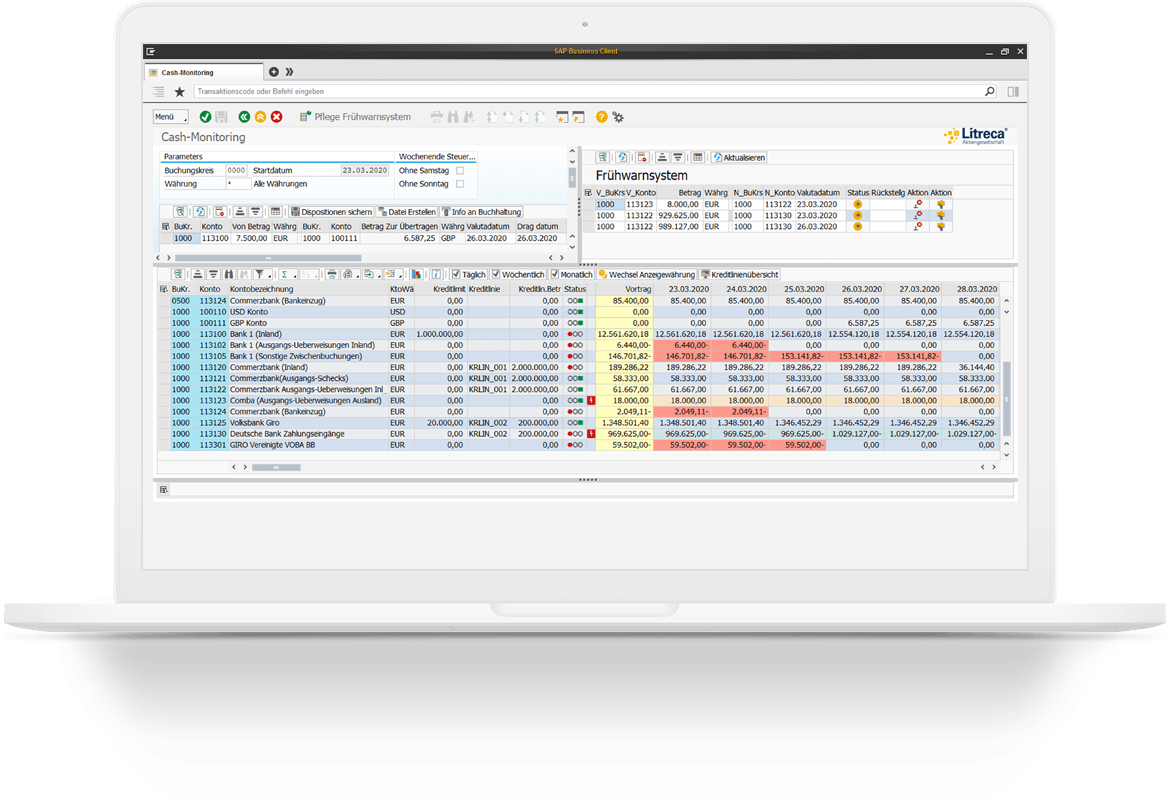

Optionally, an early warning system, known as cash monitoring, can be introduced, which automatically detects and settles account overdrafts and shortfalls if the treasurer so wishes. The degree of automation is variable, i. e. everything is possible from manual control to full compensation with preset limits and booking of transfers. To round this off, drag & drop functions save transfer problems, i. e. in the smart cash monitor, amounts can be transferred from one account to another via drag & drop. Only the approval has to be done by the Treasury itself. Everything else – including booking suggestions for the accounting department – is done fully automatically by Ltc|treasury in SAP®.

A large number of contracts can be managed as well as the individual consideration of different credit lines. In addition, there is complete documentation of all processes, which provides audit security for the Treasury department.

To ensure that communication between stakeholders is effective even in times of crisis, cross-departmental exchange can be supported by needs-based evaluations (ad hoc reports) across all modules.

- Automatic Reading of Accounts /Balances from SAP FI

- Tabular, currency-differentiated presentation of cash stocks

- Currency-differentiated tabular presentation of short-term liquidity by bank account (Preview)

- Loan management (external and intercompany)

- Cash Flow Planning (12 months rolling, short-term liquidity forecast on the day, per bank account)

- Balance monitoring with automatic disposition

- Management, documentation of FX and money market transactions (spot, swaps, forward, money trading)

- Limit and balance monitor per bank (in tabular form)

- Risk management / hedging (risk calculation, FX and interest rate strategies, options)

- SAP Analytics Cloud for Dashboard Creation

This is only a small excerpt of the functions included in Ltc|treasury in SAP. For the complete function overview, please feel free to contact us.

Then arrange a non-binding online presentation now, where you can take part from the comfort of your desk. Your personal contact person will present the system to you and competently answer your questions.

How long does it take to implement Ltc|treasury in SAP?

The time required for the conversion from an old system or from Excel to a professional TMS depends on the company’s specifics, ideally and when mapping common topics conversion is possible within 2 to 8 months, depending on the complexity.

Is Ltc|treasury in SAP release-independent?

Yes, Ltc|treasury in SAP works in its own namespace and is therefore release-independent.

Is this solution S/4HANA ready?

Yes, Ltc|treasury in SAP is S/4HANA-ready.

Can other SAP modules (e.g. SD / MM) be taken into account in the planning?

Yes, this is quite possible. We evaluate the details together in the specification workshop.

Can external data be uploaded for liquidity management?

Yes, data can be uploaded from a wide variety of data sources.

We will be happy to answer your further questions about Ltc|treasury in SAP® personally.